Over the past year, everyone has been preoccupied with the coronavirus pandemic but in parallel to dealing with the economic ramifications of the pandemic and the distribution of grants, the work of the Tax Authority continued uninterruptedly in the arena of tax collection and the enforcement of tax laws, as well as in the legal arena – where during the course of 2020 a number of dramatic precedents were set by the courts.

What was the most significant change that occurred this year? What did the public receive or lose following the changes in the tax world? What was the most important tax-related ruling of 2020? And what can we expect in terms of tax legislation in the coming year?

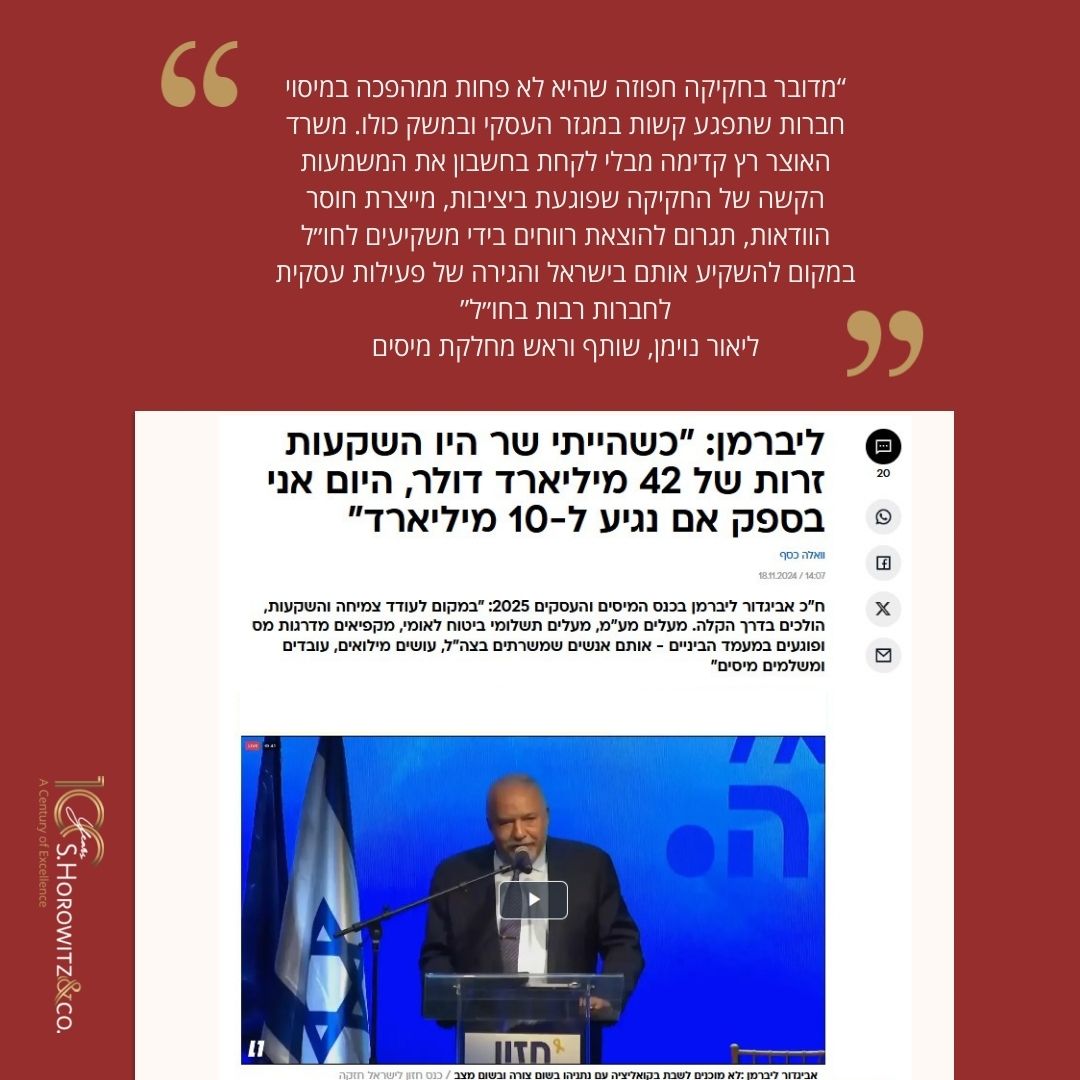

Head of our firm's Tax Practice Group, Leor Nouman, was interviewed by Globes regarding the most dramatic changes in the past tax year, ranging from the Bar Refaeli case up until the contemplated enactment of a new voluntary disclosure procedure.

To read the full article as published in Globes (in Hebrew), click here >> https://bit.ly/39LY7m5